RetireTRAC Retirement Planning System & Advanced Prospect Conversion Tool

Because Everyone Deserves a Happy Retirement

Turn prospects into clients and strengthen your existing client relationships with RetireTRAC, a retirement planning system and advanced prospect conversion tool available to all Cambridge financial professionals.

Because Everyone Deserves a Happy Retirement!

Turn prospects into clients and strengthen your existing client relationships with RetireTRAC, a retirement planning system and advanced prospect conversion tool available to all Cambridge financial professionals.

RetireTRAC is designed to immerse clients in the planning process from the very first appointment.

Through a short assessment, clients rate themselves in 20 thoughtfully chosen areas to determine their level of retirement preparedness. The results of the assessment generate a personalized RetireTRAC Score and Action Plan for the client, providing a roadmap for future appointments.

- ZFlexible system that can be easily integrated into your current process

- ZDesigned around a relatable scoring and tracking system, with results tailored to each individual

- ZSimple to understand, yet sophisticated enough for the most discerning clients

- ZAccompanying deliverables may bring added credibility and professionalism to your business

- ZBased on a modern comprehensive and holistic planning approach that integrates key non-financial topics

- ZTwo subscription levels to choose from, Bronze and Platinum

“By the prospect answering 20 questions in just a few minutes, I have all I need for a deep, detailed conversation that generally reveals more than I would have from an introductory call or meeting.”

How RetireTRAC Works

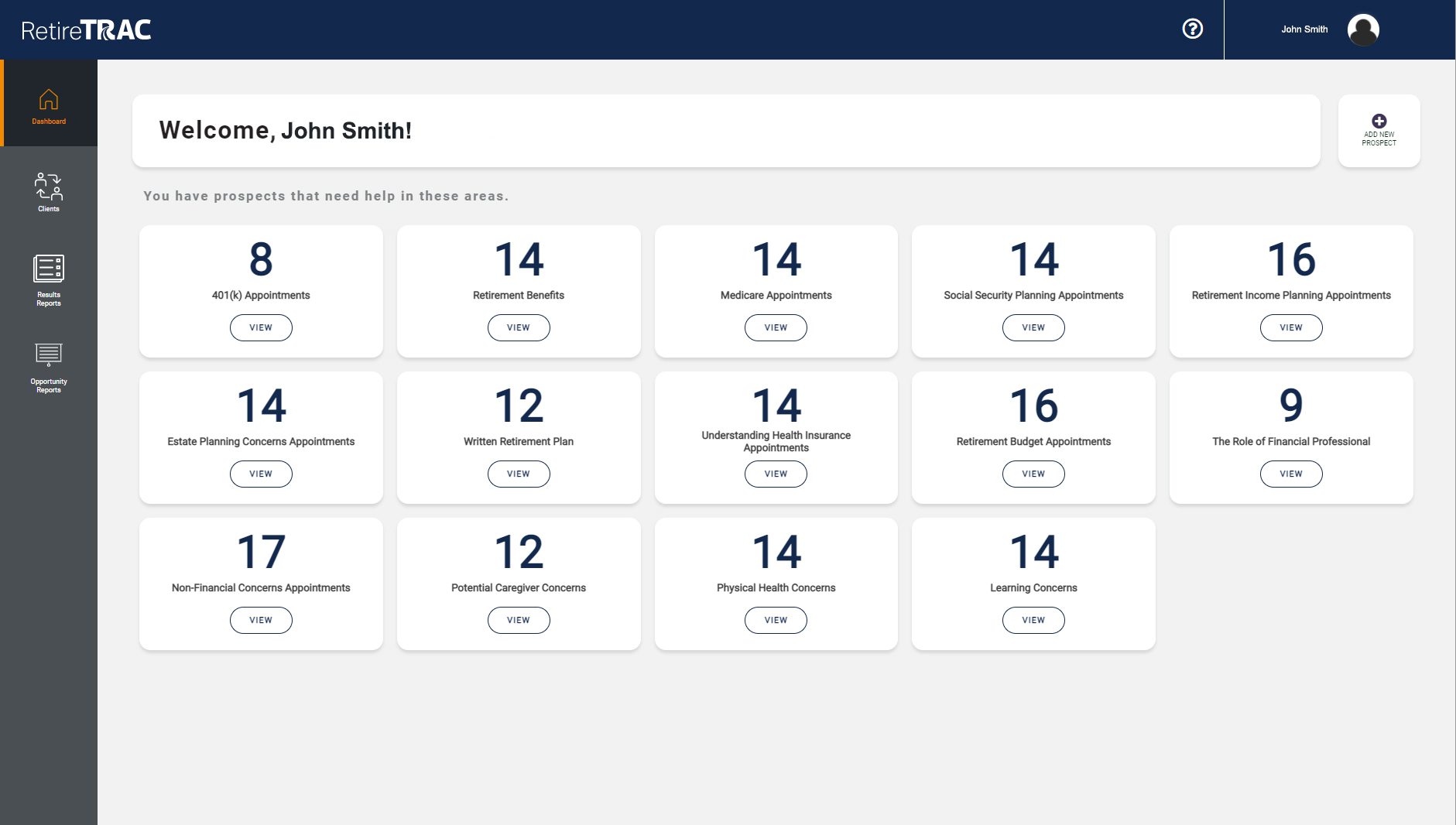

Receive your personal RetireTRAC website and dashboard.

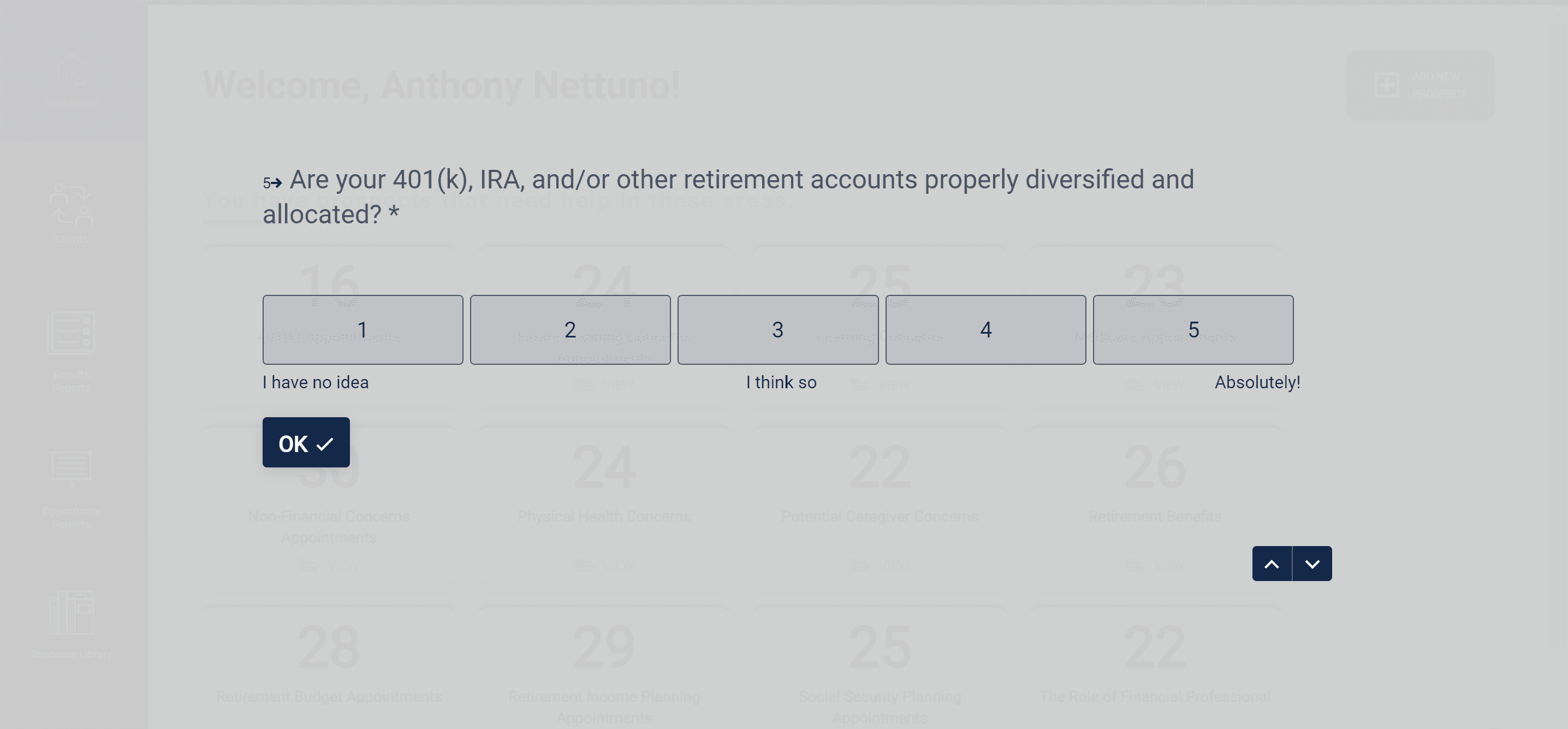

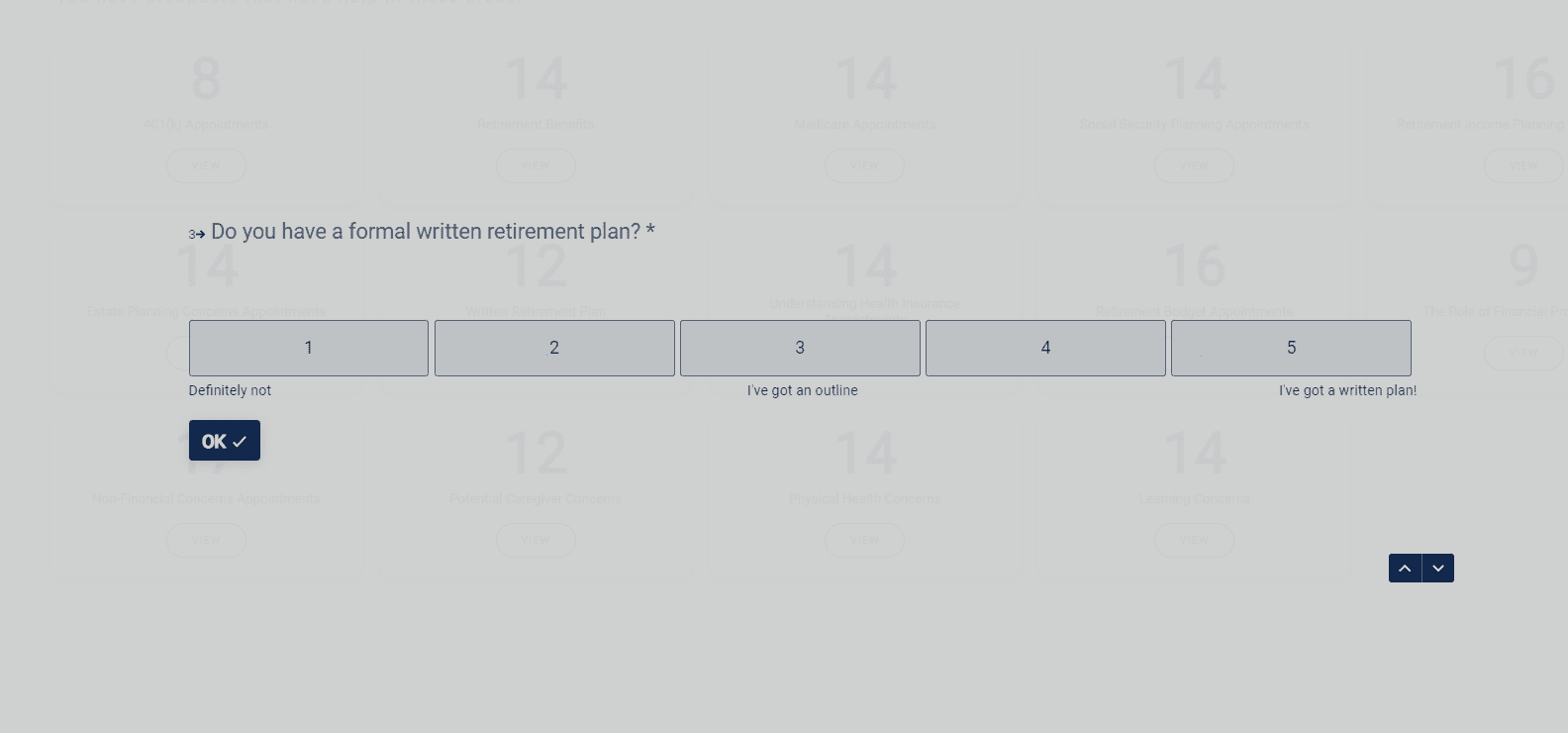

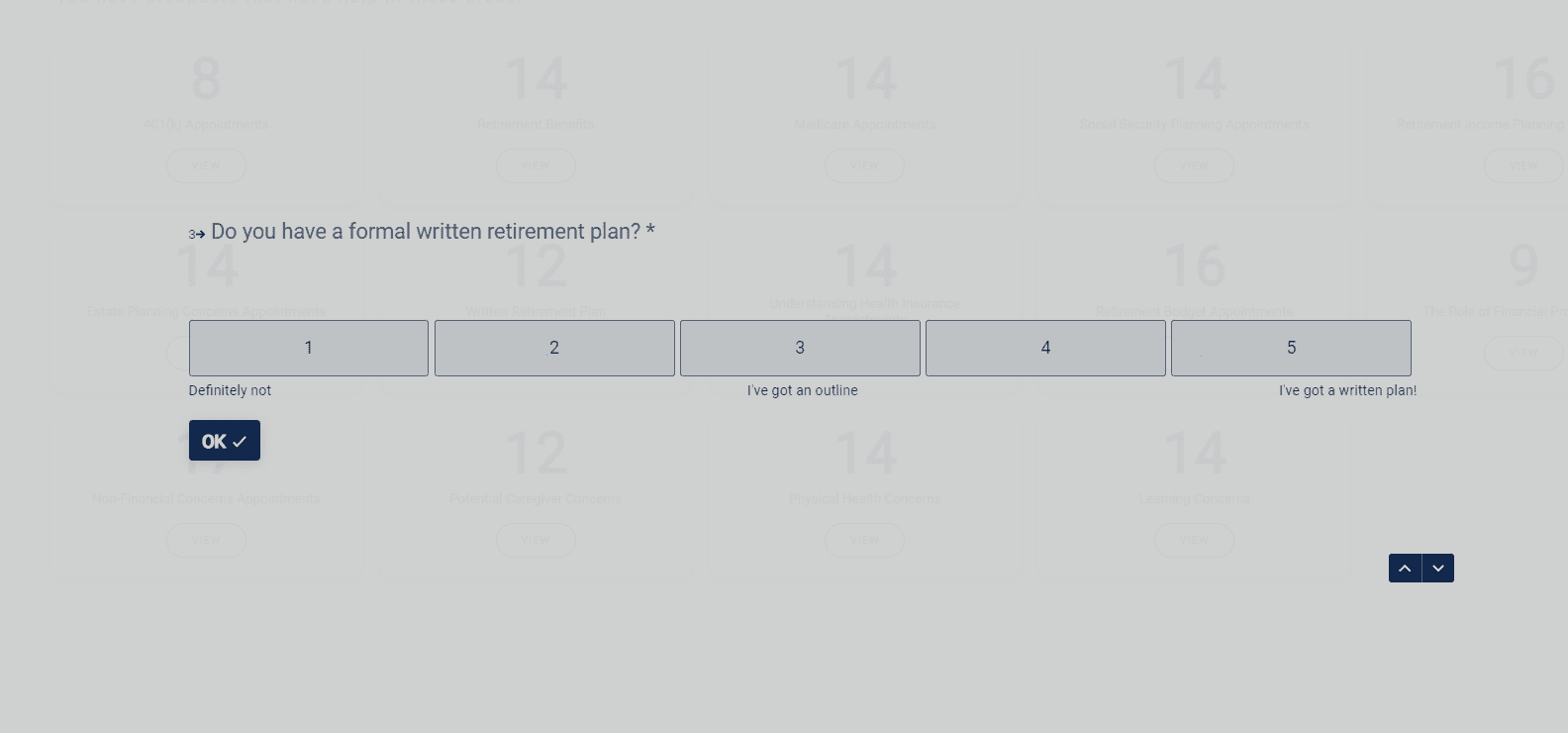

Using the assessment from your RetireTRAC website, clients and prospects answer 20 questions on a 1-5 scale (1 = not confident, 5 = confident). The five-minute assessment consists of both financial and non-financial questions.

Using the assessment from your RetireTRAC website, clients and prospects answer 20 questions on a 1-5 scale (1 = not confident, 5 = confident). The five-minute assessment consists of both financial and non-financial questions.

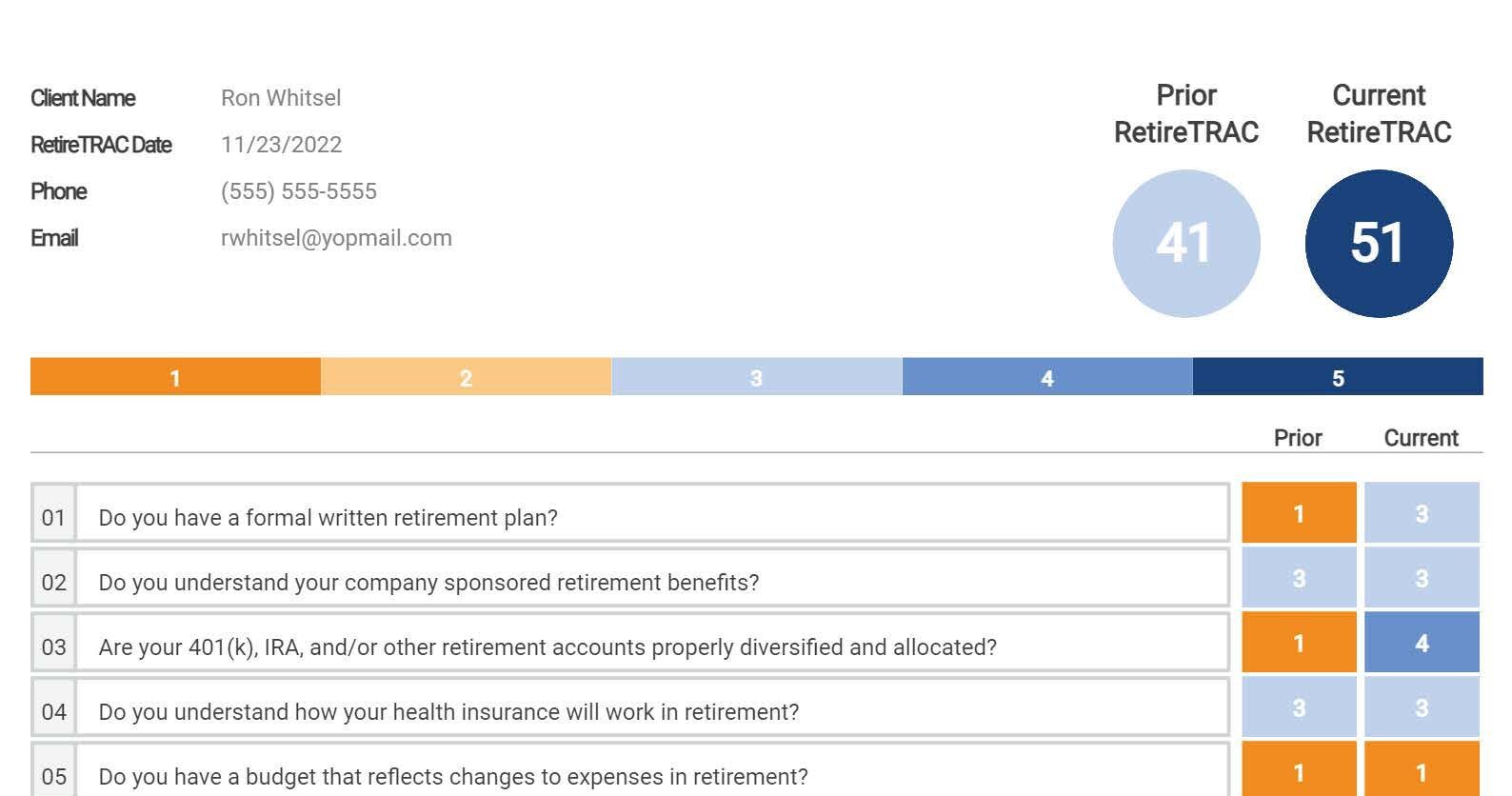

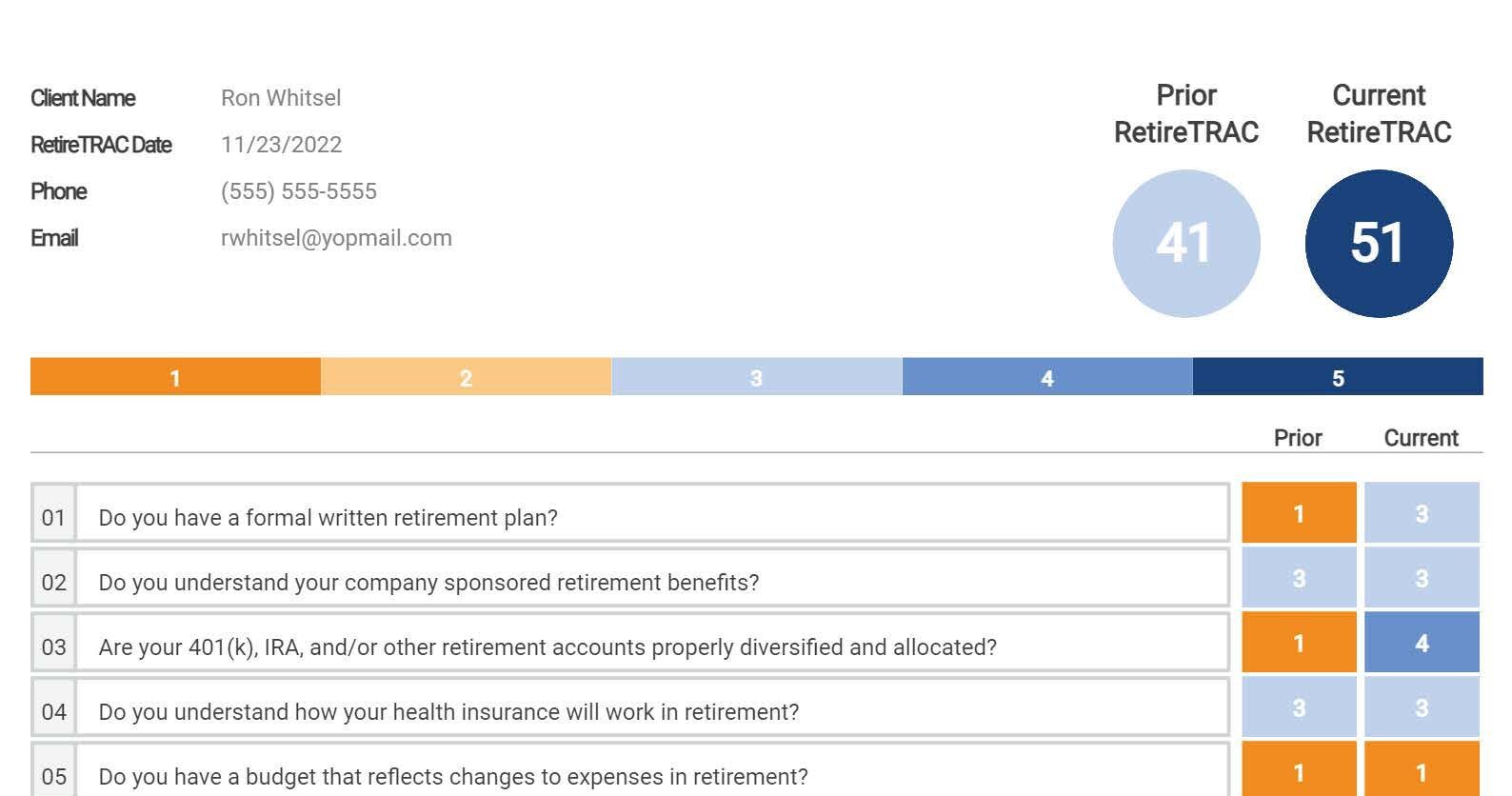

Once the assessment is complete, the client’s personalized RetireTRAC Score and Action Plan are generated as part of an eight-page report. The Score gauges where the client is at, while the Action Plan identifies items that need addressed to make their retirement vision a reality.

Use the RetireTRAC system to continually reassess clients’ retirement preparedness while working on their personalized roadmaps.

Use the RetireTRAC system to continually reassess clients’ retirement preparedness while working on their personalized roadmaps.

Bronze

$300/Month

Features Include:

Access to dashboard of client needs

The RetireTRAC dashboard organizes and displays clients and prospects based on their needs. If you want to know which of your clients need help with their 401(k), for example, you can find all of them on the dashboard in one click.

Access to standard questionnaire

Our standard questionnaire features 20 key retirement topics and serves as the blueprint to your retirement planning. It includes both financial and non-financial issues so your clients feel confident in your comprehensive planning approach.

Access to Score and Action Plan

After you and your client complete the questionnaire, RetireTRAC instantly provides a Score and Action Plan. The detailed Score report shows clients their strengths and weaknesses, and the Action Plan lays out next steps that you can help them address. Action items are personalized based on the client’s individual Score.

Individual client reporting

Each client receives personalized reporting to help them stay up to date with their retirement planning progress. This can help keep the client engaged and aware of the work you are doing on their behalf.

Client progress reports

It’s easy for clients to forget all the work you have done for them as a financial professional. The longer the process goes on, the more work you have done, and the more they tend to forget. The RetireTRAC Progress Report brings incredible clarity and comfort because it shows the client what you have accomplished from the start of the relationship.

Ability to customize Action Plan

The standard Action Plan will direct the client back to the financial professional with preset suggestions to address each of the 20 planning questions. For financial professionals that would like to incorporate more specific planning steps or solutions, customizing the Action Plan will provide this ability.

Company logo added to reports

Conveniently add your firm logo to client reports.

Topic-specific appointment presentations

These pre-approved appointment presentations can be used for in-person or virtual meetings. The presentations cover different topics included in the RetireTRAC planning process such as: Timing Social Security Benefits, 401(k) Insights, Keys to Your Happy Retirement, Essential Retirement Planning Steps, and more.

Topic-specific brochures

Our pre-approved brochures give you a professional, meaningful way to stay top-of-mind with your clients and remind them you are leading a comprehensive planning process.

Platinum

$500/Month

Includes all the features

in the Bronze Package Plus:

Ability to customize questionnaire

While the standard questionnaire is great for most, you may want to customize the questionnaire to match your existing planning process. A customized questionnaire allows for maximum flexibility.

A Flexible Solution for Today’s Financial Professionals

Still questioning if RetireTRAC can work for you and your clients? We believe the following individuals will benefit from RetireTRAC most:

- ZProfessionals who regularly discuss retirement planning with prospects and clients

- ZAnyone searching for meaningful reasons to meet with prospects and clients

- ZSecurities licensed CPAs or anyone who has relationships with CPAs or other professionals

- ZProfessionals targeting the 401(k) market

- ZProfessionals who follow a holistic planning approach or provide fee-for-service financial planning

- ZAnyone looking to boost their credibility with professional marketing resources

“Within 10 minutes, it differentiates me from everyone else and sets a foundation for a strong client-advisor relationship.”

What Financial Professionals Are Saying

Get Started

Subscribe to RetireTRAC to engage more leads and uncover new and surprising insights about your clients. Sign up today for a free 30-day trial.

Introductory Webinar

Register for our webinar to learn more about how RetireTRAC can help you capture more assets, increase your value, and protect your business.